5 Cryptocurrency to Buy for Price Boom This Weekend – November 2021 Week 1

The cryptocurrency is basically flat today, but has had a good week. At $2.86 trillion, its total cap hasn’t moved in the past 24 hours, but is up by about 6% in the last seven days. A variety of coins have contributed to this steady climb, with the likes of Binance coin (BNB), solana (SOL) and polkadot (DOT) being big winners. As such, we’ve compiled a rundown of the 5 cryptocurrency to buy for a price this weekend. This covers coins with good short- and long-term potential.

5 Cryptocurrency to Buy for Price Boom This Weekend

1. Ethereum (ETH)

ETH hit a new all-time high yesterday, of $4,674. It has since dipped by 2.7%, to $4,547. However, this represents a 1% rise in the past 24 hours and a 6% rise in the last week. It’s also up by 30% in the past month.

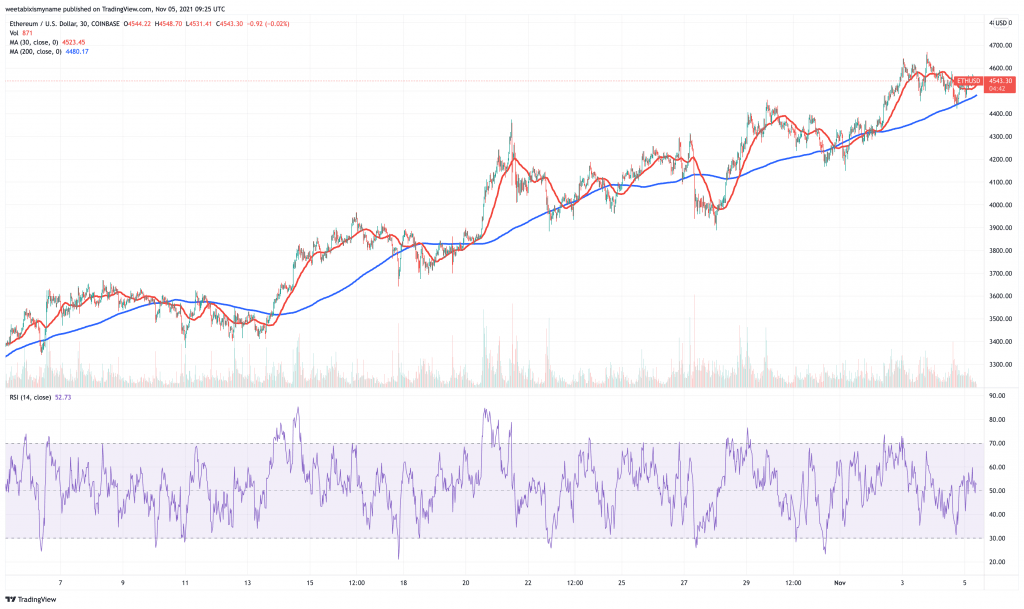

ETH’s 30-day moving average (in red above) is beginning to rise above its 200-day (in blue), indicating a new breakout. At the same time, its relative strength index (purple) is at 50 and climbing. This also suggests that it could be on the brink of an upsurge.

As we’ve written before, there are plenty of reasons to be bullish about ETH in the short-, medium- and long-term. Most notably, its issuance has recently become negative, meaning that it’s now a deflationary currency. And with supply declining over time, increases in demand will have an outsized positive effect on its price.

$ETH price breaking new highs while a record amount of 16.9k ETH was burnt in the past 24 hours

This also brings ETH’s issuance to a record low of -1.1% pic.twitter.com/UrG0g0urlO

— Lucas Outumuro (@LucasOutumuro) October 29, 2021

Magnifying this supply squeeze, more and more ETH holders are sending the coin to Ethereum 2.0’s staking contract. Indeed, this contract now holds over eight million ETH. This figure is only going to increase over time, particularly as the transition to proof-of-stake draws closer (expected some time in early 2022).

The amount of $ETH staked in the #Ethereum 2.0 contract recently surpassed the 8mm mark.

There are now 8.02m ETH with an aggregate value of +33.3b👀

Chart: https://t.co/UMGpNAVZ4F pic.twitter.com/768nZO0vH9

— IntoTheBlock (@intotheblock) October 26, 2021

On top of this, Ethereum is witnessing plenty of growth in users and holders. Indeed, Ethereum now has many millions more addresses than Bitcoin.

The number of #Ethereum holders has increased by 28.29% YTD.

This means that:

14.347m new addresses are holding ETH.

Ethereum has 26.42m more addresses with a balance than #Bitcoin

There are more $ETH addresses in a state of profit (63.44m) than the total holders in BTC (38.62m) pic.twitter.com/CR19MuJf3p— Daniel Ferraro (@danielferraros) November 2, 2021

In sum, ETH really does belong in a list of the 5 cryptocurrency to buy if you’re after a price, particularly when you remember that its total value locked has now risen to $172.8 billion.

2. Bitcoin (BTC)

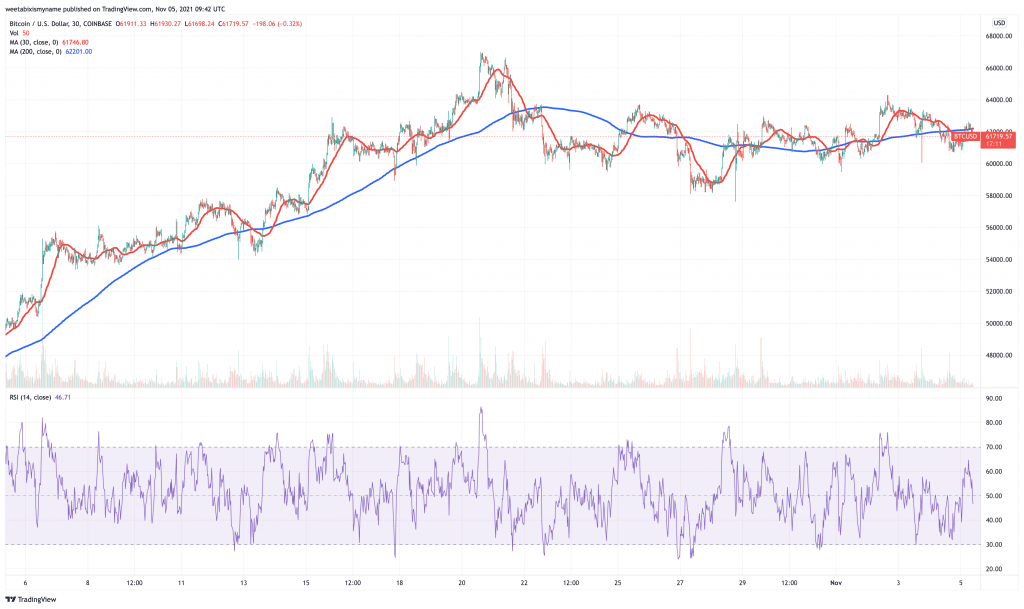

BTC’s price is a touch over $62,000. This represents a 1% rise in 24 hours, and a 2% rise in a week. At the same time, the cryptocurrency is up by 20% in a month.

Interestingly, BTC’s technical indicators have been stable for over a week. Its 30-day average is basically in line with its 200-day, while its RSI sits at just below 50. This may suggest that, after a lull, it could be on the verge of another upswing.

It’s certainly unwise to bet against bitcoin, which tends to lead big market rallies. It also tends to lead mainstream adoption as an investment asset. For example, last month the SEC gave the green light to the ProShares Bitcoin ETF, a vehicle that will encourage more mainstream investors into the market. More Bitcoin ETFs are also likely to follow, with Grayscale Investments recently applying to turn its bitcoin fund into a spot-based ETF.

And when you add rising inflation into the mix, bitcoin really could take off towards the end of the year. This is what’s predicted by the stock-to-flow model, which has proven strangely prescient so far this year. It suggests a price of around $100,000 by the start of 2022.

Like clockwork pic.twitter.com/SBjFgdmAyy

— PlanB (@100trillionUSD) November 2, 2021

3. OMG Network (OMG)

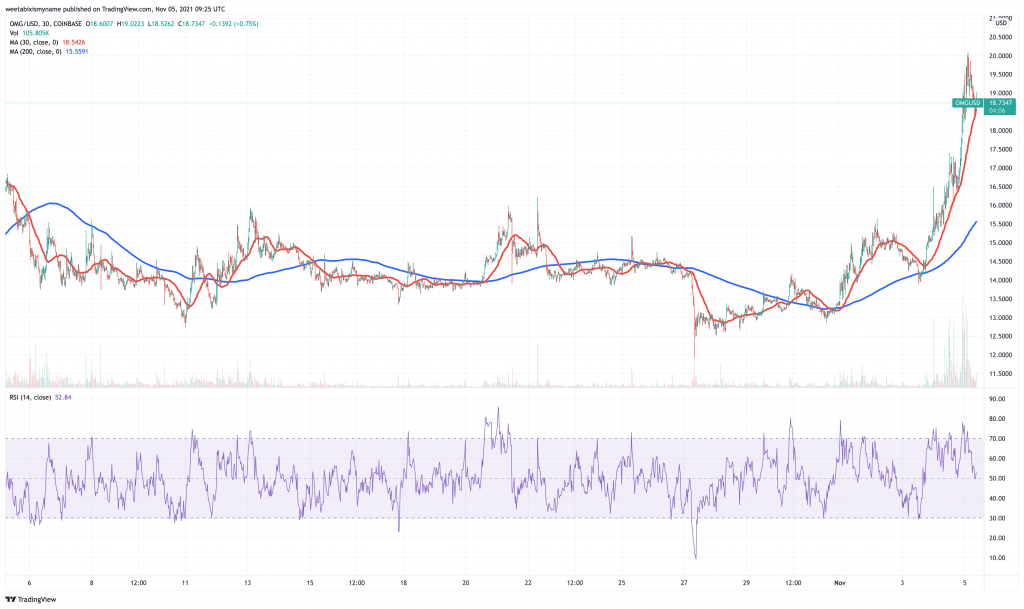

OMG is one of the biggest gainers in the past 24 hours. At $18.61, it’s up by 16% in the past day, as well as by 40% in the last week. It has also gained 20% in the last 30 days.

OMG’s 30-day average is flying well above its 200-day. This suggests that it has broken through previous resistance and is reaching a new level.

The reason for this? Well, the layer-two scaling solution for Ethereum is launching a new governance token, BOBA. This will be airdropped to holders of OMG, based on a snapshot of the OMG Network blockchain taken on November 12. More details can be found on the official website.

Basically, traders have wanted to get their hands on some free tokens, so they’ve been buying up OMG more rapidly than usual. This is likely to continue over the weekend and up until November 12. After then, who knows.

4. Polkadot (DOT)

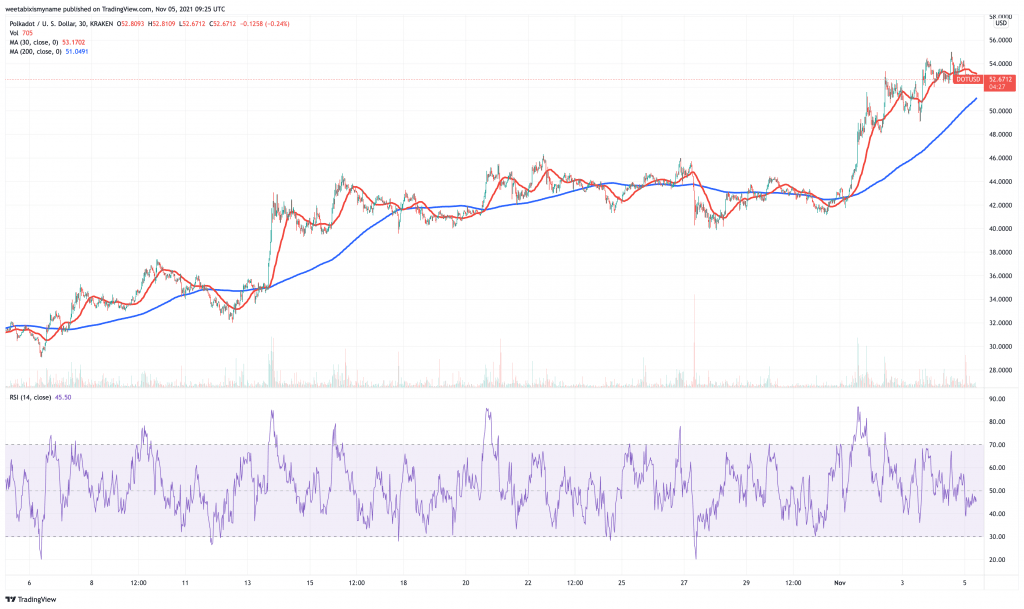

DOT set a new all-time high yesterday, reaching $54.98. It’s now down to $52.40, which is a 1.2% drop in the past 24 hours. On the other hand, it’s also a 24.6% rise in the past week, and a 66% rise in the past month.

DOT’s dip after a new record high gives new investors a good opportunity to enter its market before it gets a little too hot. At the moment, its RSI is under 50, suggesting that it’s now a buyer’s market.

And despite the small fall, DOT’s price is likely to surge over the coming days and weeks. This is because Polkadot’s parachain auctions will be getting underway from November 11. These are auctions to determine which projects can claim a parachain slot on the Polkadot network.

Referendum 42, the motion to enable parachain registration and crowdloans, has passed the community vote and been enacted. Parachain teams are now able to register their parachain and open their crowdloan ahead of the first auction on November 11, 2021. https://t.co/zFSxsozsSF

— Polkadot (@Polkadot) November 4, 2021

Hopeful parachains have to acquire and ‘bond’ (i.e. lock up) DOT in order to win the upcoming auctions. And with these auctions open to public participation (via platforms such as Kraken and Binance), it’s possible that we could see a rush of newcomers looking to acquire DOT in order to get in on the act. This effect could be ratcheted up over time by the fact that there will be a steady drip of auctions, with one scheduled per week for the next few months.

This is why it’s one of our 5 cryptocurrency to buy, particularly when you remember that new parachains will then begin using extra DOT for staking and for fees.

5. Solana (SOL)

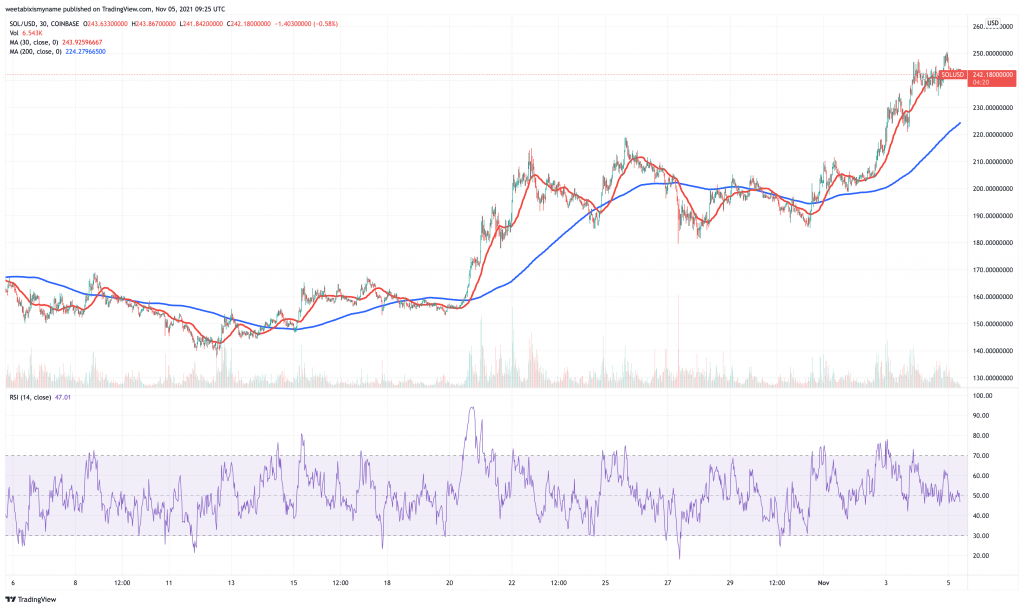

SOL has been one of this week’s best-performing coins. It reached a new all-time high of $249 yesterday, and is currently at $240. This is basically flat over the past 24 hours. That said, it represents a 23% rise in the past week and a 46% rise in the past month.

SOL continues to rise high as far as its 30-day average goes. Meanwhile, its RSI is actually in a good spot, neither overbought nor oversold. Given that it’s not overbought, this suggests its recent rally still has plenty of mileage left in it.

It’s Solana’s general growth that has been fuelling the SOL upsurge. The blockchain platform’s total value locked in has risen to nearly $15 billion in the past couple of days, up from $8 billion at the end of September, and from only $1.2 billion at the beginning of August.

This growth follows Solana branching out in all directions, with its platform support new applications of various kinds. It has witnessed the launch of new NFT-based games, for example, this week.

Gaming on Solana is heating up 🔥 https://t.co/I3mRAS5wAd

— Solana (@solana) November 4, 2021

It has also recently welcomed the launch of new DeFi platforms, thereby expanding its ecosystem and userbase.

Hxro Network is pleased to announced it has released its Parimutuel Market Protocol to @Solana Devnet.

This is the first of its kind, on-chain market primitive built natively to Solana:https://t.co/ycTj4ONclC

— Hxro.Network (@HxroNetwork) October 26, 2021

Capital at risk

Read more: