Bitcoin Price Prediction: BTC/USD Back Below $35,500

Bitcoin Price Prediction – June 12

The Bitcoin price is facing an intense tug of war as bears mount pressure near $37,500, taking the market price back below the $35,500 support zone.

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key levels:

Resistance Levels: $44,000, $46,000, $48,000

Support Levels: $28,000, $26,000, $24,000

Despite BTC/USD surging from $32,000 to $37,500, the bulls are still struggling to overcome the important resistance at $38,000 on the way to the $40,000 level. The stagnation near the $37,450 level shows that the pair is unable to increase volume to reach critical mass and overcome key hurdles with confidence.

Bitcoin Price Prediction: Could it be Bearish Confirmation?

This week, the Bitcoin price has not had much action and has traded within a range. Support and resistance levels have ensured that the daily charts are not very volatile. The price challenged the lower boundary of the channel and reached the $31,000 level. However, the sudden drop has bought back the bulls to defend the $30,000 support zone after the rapid rally has now brought BTC/USD close to the $37,500 level.

Today, the Bitcoin price couldn’t go higher as it is seen dropping below the 9-day and 21-day moving averages. Although the candle has not yet close and the bulls are unlikely to close above it. More so, should the technical indicator Relative Strength Index (14) moves below 45-level, the market price may touch the supports at $28,000, $26,000, and $24,000 but on the contrary, moving back above the 9-day and 21-day MAs could meet the resistance levels of $44,000, $46,000, and $48,000.

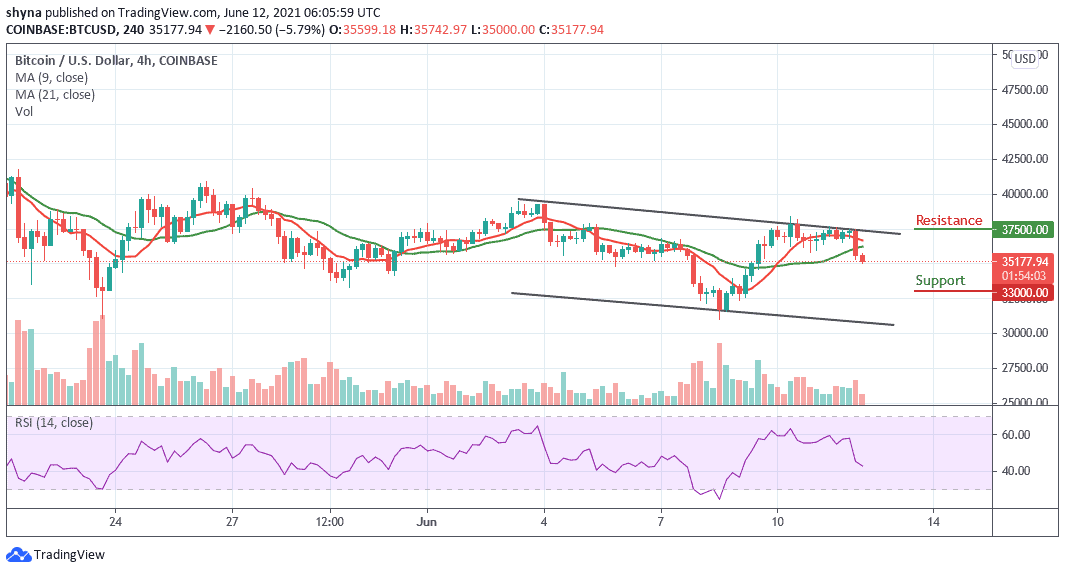

BTC/USD Medium-Term Trend: Bearish (4H Chart)

Looking at the 4-hour chart, the bears are seen coming back into the market as the bulls failed to defend the $35,500. However, the $33,000 and below may come into play if the bearish momentum increases the market movement.

However, if the buyers hijack the current movement and push it above the 9-day and 21-day moving averages, traders may expect a retest at a $37,000 resistance level; breaking this level may further allow the bulls to touch $37,000 and above. At the moment, the Relative Strength Index (14) signal line is seen moving below 45-level which could give additional bearish signals in the next negative move.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider