China Ban Spurs Crypto Fund Inflows But US Treasury Yields Hit Market

China ban fallout is still the dominant theme in the crypto market right now, with market participants mostly displaying a sigh of relief at the relative lack of damage done to the price of leading crypto assets.

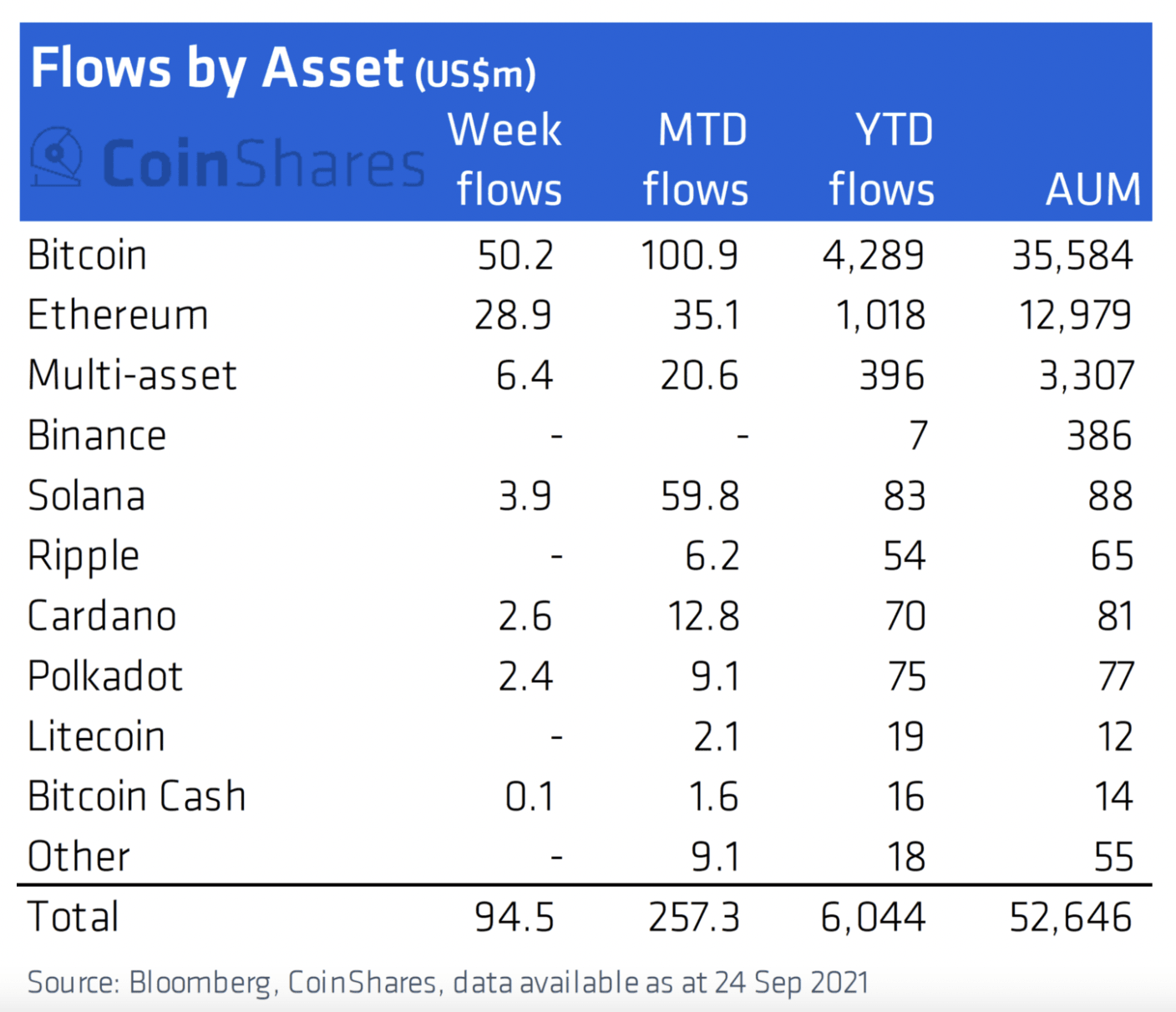

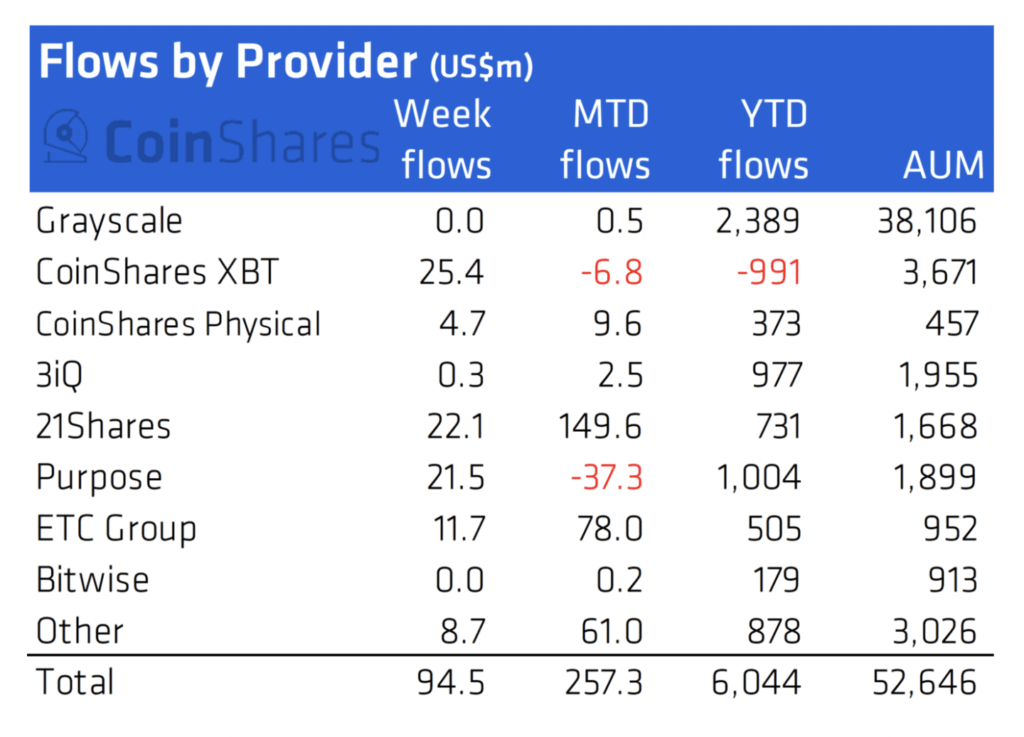

Crypto asset management firm CoinShares in its latest weekly report on fund flows relating to leading crypto investment products and top coin, thinks that the latest net inflows indicate that the China prohibition on trading crypto is being taken as a buying opportunity by investors.

If you are new to crypto and want to learn about

You can download the full CoinShares report here

China ban not hurting so much…

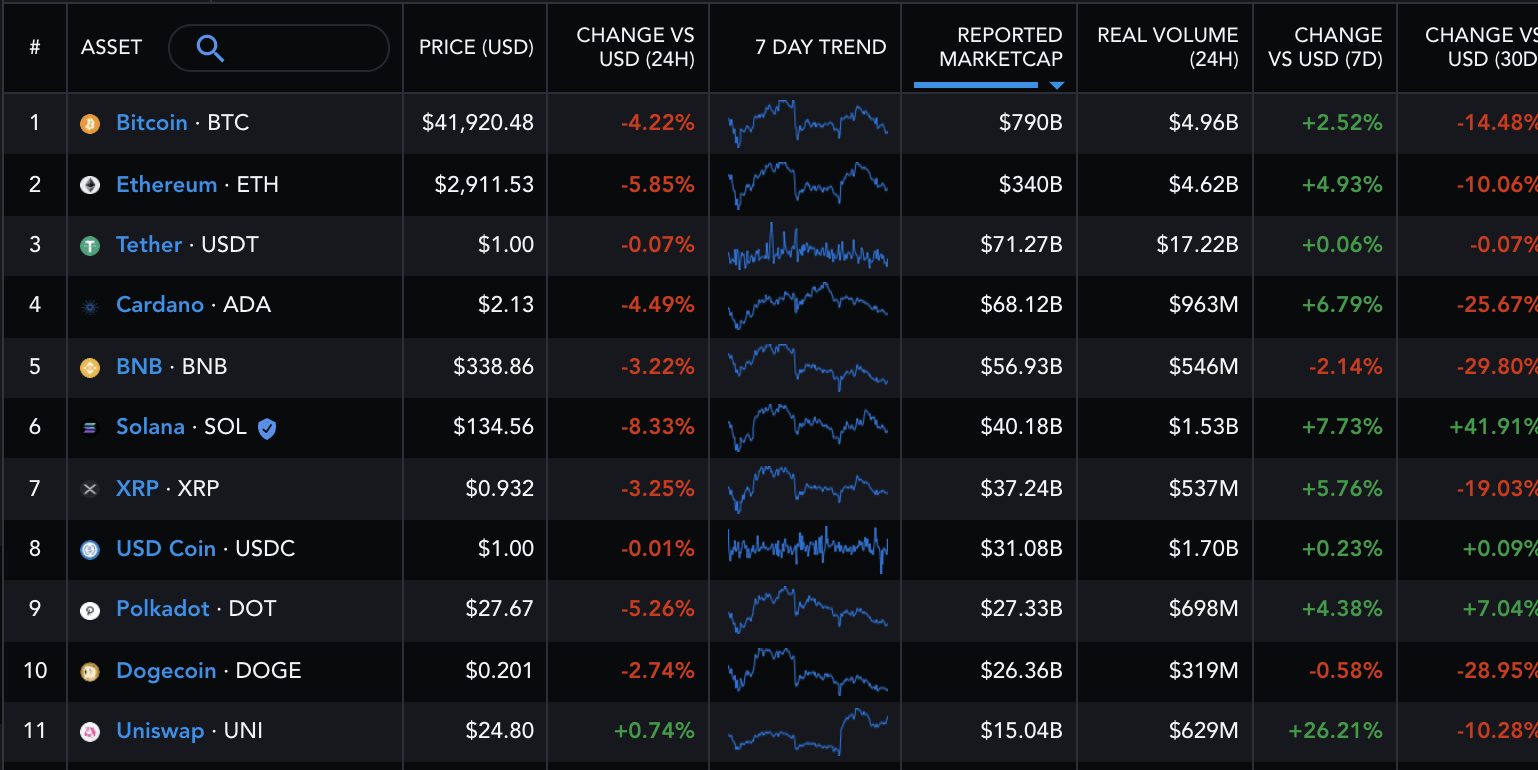

For sure there is some truth in the observation that the market has largely looked past the rebound on Sunday and Monday. However the market is down heavily in the European session, with bitcoin off 4% at $41,800.

Optimism that the China clampdown would strengthen the industry in the US and other advanced economies is warranted.

Your capital is at risk

There are a number of other positives from recent developments too, such as the removal of coal-powered bitcoin mining from the equation makes it easier for miners of proof of work protocol networks like bitcoin and ethereum to pivot towards renewable energy sources; the removal of any further uncertainty as it is now clear beyond doubt that China wants to entirely eradicate crypto from the economic landscape of the country as it clears the way for the launch of the digital yuan.

…as DEXes pick up the slack

In China itself there are indications that people are turning to DEXes such as Uniswap and Metamask in order to continue trading.

Of the top coins by market cap, Uniswap is the only one in the green among the top 30 assets.

Your capital is at risk

According to Fundstrat trading on dYdX beat out Coinbase this weekend. Sushiswap has also been doing well.

Fundstrat says a key reason why the price of bitcoin was relatively stable on the China news was because of the large proportion of hodlers. It reckons around 70% of all bitcoin in circulation is held for the long term, up from 59% in May.

However, the steady drumbeat of crypto platforms exiting China and/or closing accounts held by Chinese citizens means that there are now at 18 of them.

China e-commerce giant has also let it be known that it will cease selling of crypto mining equipment.

US debt default would lead to “extreme market reaction”

Today’s downdraft in the market is more likely the spike in yields of US Treasuries, rather than worries about China.

10-year US Treasuries are currently yielding 1.53%.

The Fed is also warning of an “extreme market reaction” should the US senate vote down a bill to raise the debt ceiling.

Up until now it has been assumed by the market that level heads will prevail and the ceiling will be lifted. If it is not then the US will default on its debt and that could send shockwaves through world financial markets.

The US treasury market ran into apparent liquidity difficulties at the beginning of the pandemic in March 2020, but those issues could be coming into view again. The $22 trillion US treasuries is the largest and most liquid financial market in the world.

In the long term a US debt default is seen as a positive for bitcoin because it could highlight how the digital asset is immune to the debasement problems that could impact the US dollar, even if in the short term bitcoin suffers from a surge in risk-off sentiment.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

Your capital is at risk